If a company’s stock experiences enough of a decline, it may reduce the amount of the dividend, or eliminate it. For example, two companies may each issue a $1 quarterly dividend and have the exact same market capitalization. However, if one company’s stock is valued at $100 and the other’s is valued at $300, one company is paying significantly more relative to what the company may be worth. The Earnings Yield Ratio shows how much of a return an investor could potentially receive from holding the company’s shares, in relation to its current share price. This means that the company’s EPS during the last 12 months was 5% of the current market value of its ordinary shares. It allows you to assess the risk and potential return of an investment, and it should be one of the main factors you consider when making decisions about where to invest your money.

How do I collect recruiting yield ratio data?

This consistent payout demonstrates that the company generates sufficient profits to share with its shareholders. Not only is this another signal of good financial health, it can be an indicator that management has a plan for the future and believes it does not need cashflow for future success. Finally, some companies pay a dividend more frequently than quarterly.

What is Yield Ratio? What is the formula and why it is important

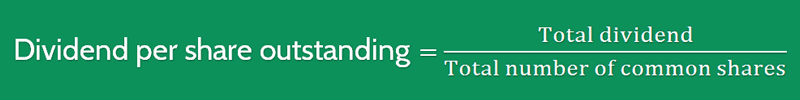

The amount of dividends paid out by a company will affect its yield ratio, as it is calculated as the dividend divided by the share price. In another scenario, let’s say the yield ratio is low between the interview stage and the job offer stage. Perhaps candidates are not being evaluated effectively, or the interview experience is not appealing to top talent. Based on this insight, you could reevaluate your interview techniques, train your interviewers to ensure consistent candidate assessment. Alternatively, you could improve your company’s employer branding to make the interview process more engaging and representative of your company culture.

What is the Diference Between Debt Yield and Cap Rate?

Yield ratio is a metric that can provide clear insight into your recruiting pipeline. It helps you understand which sources are producing the best candidates, allowing you to focus your efforts and resources on what works. Yield ratios are metrics used in recruitment to quantify the proportion of applicants who advance from one stage of the hiring process to the next. In addition, they are used to evaluate the effectiveness of various recruitment techniques and methodologies.

- The loan-to-value ratio is another popular tool commercial real estate lenders use when underwriting loans and assessing risk.

- Yield can be calculated by dividing Net Realized Return by Principal Amount of an investment.

- It’s not recommended that investors evaluate a stock based on its dividend yield alone.

- Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism.

- Bond laddering involves buying multiple bonds with different maturity dates.

If it is able to generate more revenue than expenses, then its yield ratio will be higher and vice versa. Any changes in the economic environment, including inflation and interest rates, can affect the yield ratio of a company. Look at the Yield Ratio for each individual stage, to see where you might be losing candidates.

After a deep analysis of over 2,000 interviews and various analyses and calculations, they determined that the interview questions used were outdated. To solve this, managers and interviewers underwent unconscious bias and interview simple invoices in 9 steps training. The FBI also shortened the application process, which initially required too much information in a short space of time. The FBI also tackled diversity in its special agent’s ranks when redesigning their selection process.

A monthly dividend could result in a dividend yield calculation that is too low. When deciding how to calculate the dividend yield, an investor should look at the history of dividend payments to decide which method will give the most accurate results. Along with REITs, master limited partnerships (MLPs) and business development companies (BDCs) typically can also have very high dividend yields. Treasury requires them to pass on the majority of their income to their shareholders.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. 11 Financial is a registered investment adviser located in Lufkin, Texas.