A trial balance is an accounting document that shows the closing balances of all general ledger accounts. You need to calculate the trial balance at the end of the fiscal year. The objective of the trial balance is to help you catch mistakes in your accounting. That being said, accrual accounting offers a more accurate picture of the financial state of any given business, which is why in some cases, companies are obligated by law to use this method.

Accounting cycle time period

The general journal format includes the date, accounts affected, amounts, and a brief description of the transaction. Accuracy is critical because you’ll use the financial information generated by the accounting cycle to analyze transactions and financial performance. It’s even more important for companies that need to report financial information to the SEC (Securities and Exchange Commission). For example, if the bookkeeper had debited cash by $100 and credited customer A’s account by $1,000, the credit and debit balances wouldn’t match.

- The best approach to do that is to create a system where every transaction is automatically captured because that prevents human error.

- This book is also called the book of original entry because this is the first record where transactions are entered.

- After analyzing transactions, now is the time to record these transactions in the general journal.

- When you record transactions in the journal depends on whether you use cash or accrual accounting.

- The balance sheet is a depiction of the financial position of the business entity.

Post Adjusting Journal Entries to General Ledger

This entry needs to reference where the error exists so that anyone reviewing it can verify it for accuracy. If a transaction is identified but it isn’t recorded, then it’s like it never happened at all. As an accounting student or professional, you must be well aware of the complete accounting cycle. It is a complete process where an accountant or the bookkeeper performs accounting tasks. Most companies today use accounting software for improved accuracy and faster accounting.

What is an accounting cycle process example?

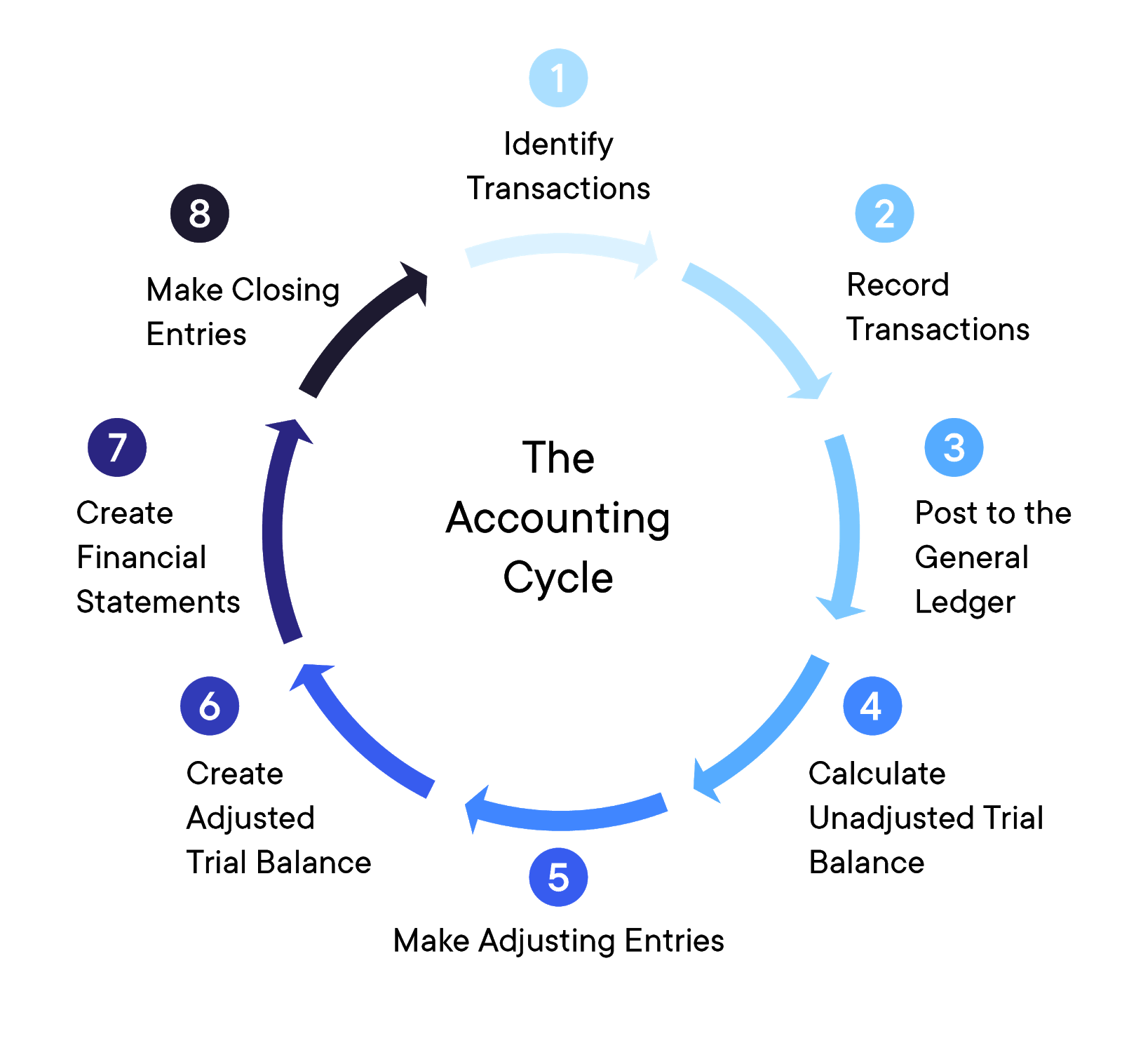

Closing is usually a good time to file paperwork, plan for the next reporting period, and review a calendar of future events and tasks. Finally, a company ends the accounting cycle in the eighth step by closing its books at the end of the day on the specified closing date. The closing statements provide a report for analysis of performance over the period. Generally accepted accounting principles (GAAP) require public companies to use accrual accounting for their financial statements, with rare exceptions. Each step in the accounting cycle is equally important, but if the first step is done incorrectly, it throws off all subsequent steps.

Modifications for accrual accounting versus cash accounting are often one major concern. The next step in the accounting cycle is to post the transactions to the general ledger. Think of the general ledger as a summary sheet where all activity based transactions are divided into accounts. It lets you track your business’s finances and understand how much cash you have available. As a small business owner, it’s essential to have a clear picture of your company’s financial health.

Simply put, the ledger collates all records made to specific accounts. For example, all journal entry records made to “Cash” are posted into the Cash account in the ledger. After posting is complete, we will be able to see all increases and decreases in Cash; and from that, we can determine the remaining balance. Business transactions are usually recorded using the double-entry bookkeeping system.

Remember that you don’t have to implement the accounting cycle as-is. You can modify it to fit your company’s business model and accounting processes. With that foundation set, let’s talk about the eight accounting cycle steps in detail. The accounting cycle includes eight steps required to record transactions during an accounting period. In this guide, I explain the steps in the accounting cycle in detail, with examples.

This process ensures a clear, well-organized, and accurate representation of a company’s financial activity, laying the foundation for subsequent steps in the accounting cycle. Understanding the accounting cycle is vital for business owners and professionals in the accounting field. It provides a solid foundation for analyzing a company’s financial health, making informed decisions based on accurate data, and maintaining a well-organized record-keeping system.